Salamat Right Choice! Ang bilis ng process at madali mag

apply ng loan dito basta kumpleto and requirements nyo.

Naka loan ako ng 50k at narelease din ito kaagad after 5

days.

Andrew P.

Mas madali pala mag apply ng loan using their mobile app. Wala namang issue since complete requirements ako at narelease din kaagad ang loan ko sa mobile app nila. Madali din mag transfer ng funds using their ewallet.

Jenny A.

Buti nakita ko tong Right Choice. Kaylangan ko talaga ng pondo para sa mga bayarin ko. At first akala ko matagal sila mag process pero nung nainstall ko na yung app nila, ang bilis nlng din pala. Salamat sainyo

Mark D.

Less hassle mag apply ng loan dito. Madali lang ako nakapag apply gamit yung app nila. Legit tlga to. Released din agad ang loan ko after ko masubmit lahat ng requirements ko sakanila. Nakatulong din ang customer service nila para mas mapabilis ang proseso. Salamat

Jasper T.

Within 24 to 48 hours

Our minimum loan amount is Php20,000 and our maximum is Php3,000,000. The specific amount you are eligible to borrow depends on your loan application details and our credit review process.

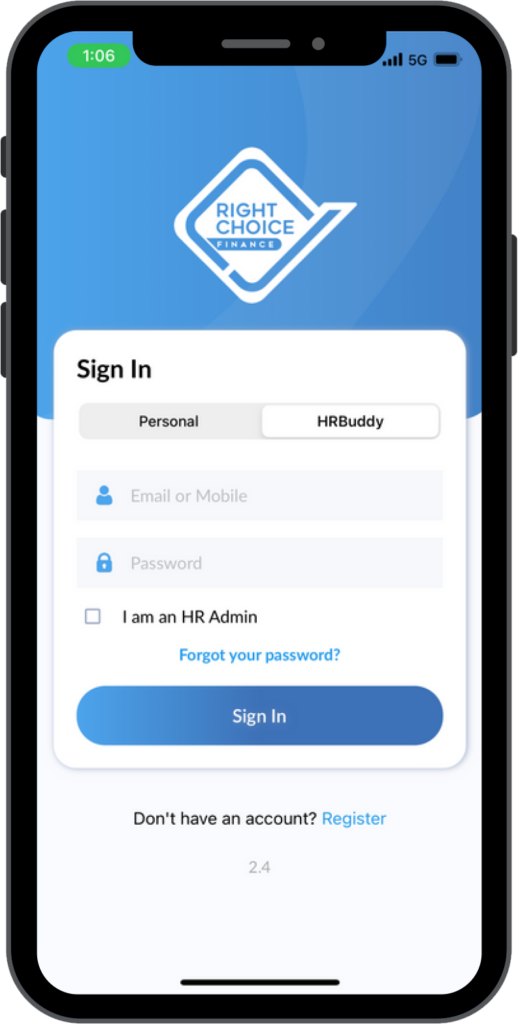

Step 1: Download the App on Your Mobile

Step 2: Create RCF Wallet Account and Get Verified

Step 3: Select Your Loan (Salary, Employee, Business, Auto and Home Loan)

Step 4: Upload Your Requirements to the App

Step 5: Wait for Loan Approval

Step 6: Receive Funds in Your RCF Wallet

Applying for a loan is FREE. We only charge a processing fee from the principal of your approved loan amount disbursed to you.

For Business Loan

1. Completely filled-out online loan application form

2. Valid IDs (1 Primary and 1 Secondary)

3. Business Permit (DTI/Mayor’s Permit, etc)

4. Latest ITR and Financial Statement

5. SEC Papers (for Corporation)

6. Bank Statement (6months latest)- Checking/Savings

7. PDC (Post Dated Checks)

8. Bank statements via BRANKAS for faster processing within 24 hrs. (accredited banks BDO, RCBC, PNB, Metrobank & BPI) or manually upload the bank statements (latest 6 mos.) for banks not accredited by BRANKAS

For Personal Loan

1. Certificate of Employment

2. Payslip (3 months)

3. Proof of Billing

4. 2 Valid IDs

5. Location Selfie (w/ residence facade that includes house number as background)

6. Bank statements via BRANKAS for faster processing within 24 hrs. (accredited banks BDO, RCBC, PNB, Metrobank & BPI) or manually upload the bank statements (latest 6 mos.) for banks not accredited by BRANKAS.

7. Post Dated Checks (PDCs)

For Car Loan

1. Completely filled-out online loan application form

2. 2 Valid IDs (1 Primary and 1 Secondary)

3. Payslip (3 months latest)

4. COE (latest)

5. Bank statement (6 months latest) – checking/savings

6. Proof of billing (Brgy. Clearance is needed if the place is rented)

7. PDC

8. Collateral documents (latest Official Receipt / Certificate of Registration, etc.)

For Home Loan

1. Completely filled-out online loan application form

2. 2 Valid IDs (1 Primary and 1 Secondary)

3. Payslip (3 months latest)

4. COE (latest)

5. Bank statement (6 months latest) – checking/savings

6. Proof of billing (Brgy. Clearance is needed if the place is rented)

7. PDC

8. Collateral documents (copy of TCT or CCT / Tax Clearance / Lot Plan w/ vicinity Map, etc.)

Your loan repayment agreement is legally binding and valid. If you cannot make a payment on time, you can contact us ahead of your due date so we can work with you on a payment arrangement. Applicable penalty fees and charges shall apply to all missed payments in accordance with our loan agreement.

| LANDLINE | : | +632 72153220 |

| MOBILE | : | +63 9171142081 |

This feature is not available from your current location

Head Office